Boy, this is a tough market! Certainly, I like days that we rally; 'cause this is "happy" trading! Then, I'm more excited to look at stocks because they are much more pleasant to look at. But, you'd have to look at the chart signals, "technically", and not emotionally. So, let's see what we have:

Nasdaq closed just below the 10-day MA.

We have a support level at 2401, which now pretty much coincides with the 20-day MA. The MACD and RSI have been sliding the past couple of days. Let's take a look at the intraday chart:

We see that we pretty much reached the top on 3/21 at around 2460. Didn't have quite enough momentum to push through that resistance, as most of other indicators (MACD, MFI, RSI) also topped out. Now, we have the support at around 2401. We can see that the same indicators are beginning to bottom out. The question for tomorrow, and perhaps the next couple of days, would be "would this support hold?" Can we bounce off and create a near-term range bottom to re-test 2460? We'll have to patiently, but, vigilently, wait and see. (The Nasdaq chart resembles those of the other indices, ie. SPX, DJI...etc, for the near-term.)

Now, SOX, the index for the semi-conductors, a sector that is very important for sustainable rallies in techs, really needs to get its acts together.

It closed below the mid-point level of the trading range that we've been in, at around 474 (the green line across the chart). We're now sitting right at the next support line, around 469.

Apparently, the "W" pattern that I pointed out a few days ago did not take off like last time in November. This time, we're testing the bottom from our recent bounce again. Hope the 469 level holds, or, we might test 460 level again.

Ok, let's talk about something brighter! Like Cramer says, "There's always a bull-market somewhere!"

CN had a nice day today. It showed the similar pattern as many other stocks for the past few weeks (coming up to resistance level, with upper BB very close by). But, today, it broke resistance and actually caught the upper BB.

The other indicators (MACD, MFI, RSI, and volume) are all looking great, too! We might see CN start climbing that upper BB! Go CN!!

What's positive for today was that the 30-day MA finally turned up! We'll have to see now if the 10-day MA can act as a support, while the intraday charts work off some steam!

What's positive for today was that the 30-day MA finally turned up! We'll have to see now if the 10-day MA can act as a support, while the intraday charts work off some steam! On the intraday chart, we can see that Nasdaq really hit the tops of this near-term cycle at the end of last week. It was able to sustain the levels as things started to cool off earlier this week; probably people wanted to wait and see what comes out of the Fed's minutes.

On the intraday chart, we can see that Nasdaq really hit the tops of this near-term cycle at the end of last week. It was able to sustain the levels as things started to cool off earlier this week; probably people wanted to wait and see what comes out of the Fed's minutes.  It closed below the support around 12500, but, it did bounce off of the 10-day MA. The SP 500 shows similar charts to Nasdaq.

It closed below the support around 12500, but, it did bounce off of the 10-day MA. The SP 500 shows similar charts to Nasdaq.

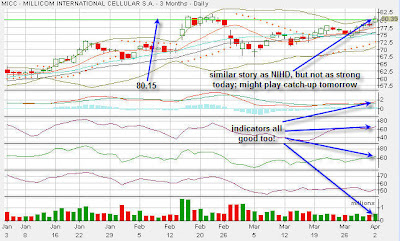

Indicators are all good and the volume went up a bit. 52-wk high is not that far away at 82.04. Catching the upper BB and closing above the resistance (80.15) may allow it to play some catching-up tomorrow and head for a new 52-wk high!

Indicators are all good and the volume went up a bit. 52-wk high is not that far away at 82.04. Catching the upper BB and closing above the resistance (80.15) may allow it to play some catching-up tomorrow and head for a new 52-wk high! It broke above resistance @ 45.5 with great volume. This thing may be ready for a new 52-wk high also, which is only 48.45.

It broke above resistance @ 45.5 with great volume. This thing may be ready for a new 52-wk high also, which is only 48.45.

It's not very clear from GLD's monthly chart to tell where it is heading next. It managed to close above the resistance at 65.3. The MFI looks like it might be bottoming out. If the MFI starts to go up, GLD could go much higher. The monthly MAs are still going up, although the 10-month MA looks like it may be flattening out. The BBs are narrowing in, so, it may be range-bound.

It's not very clear from GLD's monthly chart to tell where it is heading next. It managed to close above the resistance at 65.3. The MFI looks like it might be bottoming out. If the MFI starts to go up, GLD could go much higher. The monthly MAs are still going up, although the 10-month MA looks like it may be flattening out. The BBs are narrowing in, so, it may be range-bound.

Apparently, the "W" pattern that I pointed out a few days ago did not take off like last time in November. This time, we're testing the bottom from our recent bounce again. Hope the 469 level holds, or, we might test 460 level again.

Apparently, the "W" pattern that I pointed out a few days ago did not take off like last time in November. This time, we're testing the bottom from our recent bounce again. Hope the 469 level holds, or, we might test 460 level again.

It had great buying volume, again. If the 20-day MA curves up tomorrow and stays above the 30-day MA without crossing it, it would be a very bullish sign; and, the momentum might pick up even more!

It had great buying volume, again. If the 20-day MA curves up tomorrow and stays above the 30-day MA without crossing it, it would be a very bullish sign; and, the momentum might pick up even more! ATI needs to break above that resistance at 139.4 and catch the upper BB. I think it should be ATI's turn to break out soon!

ATI needs to break above that resistance at 139.4 and catch the upper BB. I think it should be ATI's turn to break out soon!

Similar story: it closed right at resistance and has caught the upper BB. Nice MA, MACD, and buying volume. Ready to break out!

Similar story: it closed right at resistance and has caught the upper BB. Nice MA, MACD, and buying volume. Ready to break out!