Nasdaq closed above the 30-day MA.

But, we still need to see that 30-day MA turn up (same story for the SPX, or SP 500). The 20-day MA is now going up nicely (blue line).

But, we still need to see that 30-day MA turn up (same story for the SPX, or SP 500). The 20-day MA is now going up nicely (blue line). The intraday, hourly chart can perhaps provide some missing clues. After we tested the bottom last Thursday, some sorting out and back-and-forth needed to happen. We see that Nasdaq now have gotten above the intraday MAs (similar actions exist for the SPX), we might see some upwards momentum tomorrow.

The intraday, hourly chart can perhaps provide some missing clues. After we tested the bottom last Thursday, some sorting out and back-and-forth needed to happen. We see that Nasdaq now have gotten above the intraday MAs (similar actions exist for the SPX), we might see some upwards momentum tomorrow.The telecoms did well today. NIHD was one of the leaders.

It made a nice advance above the resistance at 75.3 and had great volume to go with it. The MFI, RSI, MACD are all looking good. Might be in the 80s soon.

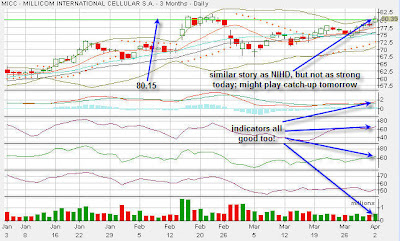

It made a nice advance above the resistance at 75.3 and had great volume to go with it. The MFI, RSI, MACD are all looking good. Might be in the 80s soon.MICC had some similar actions as NIHD, but, not quite as strong.  Indicators are all good and the volume went up a bit. 52-wk high is not that far away at 82.04. Catching the upper BB and closing above the resistance (80.15) may allow it to play some catching-up tomorrow and head for a new 52-wk high!

Indicators are all good and the volume went up a bit. 52-wk high is not that far away at 82.04. Catching the upper BB and closing above the resistance (80.15) may allow it to play some catching-up tomorrow and head for a new 52-wk high!

KYPH had a nice day, also!  It broke above resistance @ 45.5 with great volume. This thing may be ready for a new 52-wk high also, which is only 48.45.

It broke above resistance @ 45.5 with great volume. This thing may be ready for a new 52-wk high also, which is only 48.45.

No comments:

Post a Comment