Nasdaq

Nasdaq managed to close above the 2500 support level to close at 2505.35. It needs to catch...

Nasdaq managed to close above the 2500 support level to close at 2505.35. It needs to catch...***If you want to read the rest of the post, please click here to go to Wang's World!

This is my personal blog on the stock market, started on 3/18/07. I write as if I am thinking out loud, and, I use it to track my own thoughts on the markets. Please read it at your own risk and see the "Disclaimer" below in the side column. Thank you for visiting!

Nasdaq managed to close above the 2500 support level to close at 2505.35. It needs to catch...

Nasdaq managed to close above the 2500 support level to close at 2505.35. It needs to catch...***If you want to read the rest of the post, please click here to go to Wang's World!

New all-time high, just climbing the upper BB! (Why do I keep on hearing Mike Myer’s voice saying what I’m typing?!) It is above 12800 boys and girls! SPX, the SP 500 index, shares the same qualities as DOW’s charts, “just climbing the upper BB”.

New all-time high, just climbing the upper BB! (Why do I keep on hearing Mike Myer’s voice saying what I’m typing?!) It is above 12800 boys and girls! SPX, the SP 500 index, shares the same qualities as DOW’s charts, “just climbing the upper BB”.Nasdaq had a little more difficult time today, even though the SOX took off! IBM and YHOO may have something to do with it...

***If you want to read the rest of the post, please click here to go to Wang's World!

Nasdaq closed right above its daily upper BB. MAs are still going up nicely, and so is the MACD.

Nasdaq closed right above its daily upper BB. MAs are still going up nicely, and so is the MACD. Perhaps the intraday chart shows a more meaningful picture. The "little rest" today allowed Nasdaq to let off some steam in the MFI, while not losing any altitude. Now, it has more room to continue to up-trend. Perhaps we'll see it continue to climb its upper BB!

Perhaps the intraday chart shows a more meaningful picture. The "little rest" today allowed Nasdaq to let off some steam in the MFI, while not losing any altitude. Now, it has more room to continue to up-trend. Perhaps we'll see it continue to climb its upper BB! It gained 2.95 to close at 96.15, above the range that it had been trapped in for a week. It had a nice buying volume and looks like it might try testing 100, again, soon!

It gained 2.95 to close at 96.15, above the range that it had been trapped in for a week. It had a nice buying volume and looks like it might try testing 100, again, soon! Both INTC and IBM reported solid earnings AH. So, let's see if the markets will continue to push upwards.

Nasdaq caught up with its daily upper BB today and it is within range to overtake its Feb. high! The daily MAs are curving up even more, gaining momentum!

Nasdaq caught up with its daily upper BB today and it is within range to overtake its Feb. high! The daily MAs are curving up even more, gaining momentum!SOX SOX managed to eke out a gain, but, need some big moves to catch up with other sectors. The good thing is that the daily MAs seem to start to curve up again! It needs good earnings news from some of the big industry names, such as INTC and TXN! If these big semiconductor stocks start to run, it should provide SOX with some needed momentum.

SOX managed to eke out a gain, but, need some big moves to catch up with other sectors. The good thing is that the daily MAs seem to start to curve up again! It needs good earnings news from some of the big industry names, such as INTC and TXN! If these big semiconductor stocks start to run, it should provide SOX with some needed momentum.

OIH  Another nice advance for OIH. It's riding the upper BB up nicely. Buying volume increased again. Although the daily techinical indicators may be toppy, the month chart still shows room for more upwards action!

Another nice advance for OIH. It's riding the upper BB up nicely. Buying volume increased again. Although the daily techinical indicators may be toppy, the month chart still shows room for more upwards action!

GLD GLD had a little breakout today. Closing above its 6-month high of 68 on high volume!

GLD had a little breakout today. Closing above its 6-month high of 68 on high volume!

Markets are hot!! Let's hope that SOX, the semiconductors, will start catching up with the other sectors this week! Happy trading!

It's great to see the consecutive "up" days to catch the upper BB. This is the type of action that I was anticipating last week! Nasdaq and the DOW have both caught their daily upper BB also, but, still waiting to break through their Feb. highs.

It's great to see the consecutive "up" days to catch the upper BB. This is the type of action that I was anticipating last week! Nasdaq and the DOW have both caught their daily upper BB also, but, still waiting to break through their Feb. highs.

It is less than 9 points away from 2500, the level before the sell-off. The daily MAs are moving up nicely, and both the MACD and the RSI are going strong!

It is less than 9 points away from 2500, the level before the sell-off. The daily MAs are moving up nicely, and both the MACD and the RSI are going strong! We can see higher highs and higher lows on Nasdaq's weekly chart, and the SAR has just turned up. Weekly MACD and RSI continue to rise!

We can see higher highs and higher lows on Nasdaq's weekly chart, and the SAR has just turned up. Weekly MACD and RSI continue to rise!SPX, SP 500, is still strong!  It's weekly chart shows that it closed "above" the level before the sell-off (1450), and it's ready to test the February high at around 1461, less than 9 points away!

It's weekly chart shows that it closed "above" the level before the sell-off (1450), and it's ready to test the February high at around 1461, less than 9 points away!

The oil service companies, represented by OIH, have gone higher, also! Its weekly chart shows a very bullish picture: has caught up with the weekly upper BB; MAs lined up with 10- above 20- above the 30-week MA; its MACD, MFI, RSI, and volume are all rising strongly!

Its weekly chart shows a very bullish picture: has caught up with the weekly upper BB; MAs lined up with 10- above 20- above the 30-week MA; its MACD, MFI, RSI, and volume are all rising strongly!

GLD, or gold, is not doing bad either:  GLD is almost touching the weekly upper BB; its SAR has turned up; MACD, MFI, and RSI are rising, also!

GLD is almost touching the weekly upper BB; its SAR has turned up; MACD, MFI, and RSI are rising, also!

So, the markets seem to be ready to test the Feb. highs! Nasdaq is getting stronger with lots of help from the biotechs. We still need to see the semiconductors join the rally and break above its multi-year range. The oils and metals are still strong!

Nasdaq managed to close above 2480! In the chart, we can see that all daily MAs are now rising up and the 10- is above the 20- is above the 30-day MA. These could be bullish signals to pick up more momentum. Maybe we'll start to see some consecutive "up" days to catch the upper BB and, perhaps, to test the Feb. highs!

Nasdaq managed to close above 2480! In the chart, we can see that all daily MAs are now rising up and the 10- is above the 20- is above the 30-day MA. These could be bullish signals to pick up more momentum. Maybe we'll start to see some consecutive "up" days to catch the upper BB and, perhaps, to test the Feb. highs! It gained almost 3 points to catch up with its daily upper BB on solid buying volume!

It gained almost 3 points to catch up with its daily upper BB on solid buying volume!And, it seems like the chinese stocks are hot again, as the ETF tracking the chinese stocks, FXI, gave another good showing. FXI, with a 2.48% gain, also caught up with its upper BB on rising volume!

FXI, with a 2.48% gain, also caught up with its upper BB on rising volume!

LAM Research, LRCX, reported good earnings AH. This might give the SOX some more fuel tomorrow. It sure needs more momentum to push through its multi-year range. And, Nasdaq might be able to push higher with both biotechs and semiconductors leading the way!

What's positive for today was that the 30-day MA finally turned up! We'll have to see now if the 10-day MA can act as a support, while the intraday charts work off some steam!

What's positive for today was that the 30-day MA finally turned up! We'll have to see now if the 10-day MA can act as a support, while the intraday charts work off some steam! On the intraday chart, we can see that Nasdaq really hit the tops of this near-term cycle at the end of last week. It was able to sustain the levels as things started to cool off earlier this week; probably people wanted to wait and see what comes out of the Fed's minutes.

On the intraday chart, we can see that Nasdaq really hit the tops of this near-term cycle at the end of last week. It was able to sustain the levels as things started to cool off earlier this week; probably people wanted to wait and see what comes out of the Fed's minutes.  It closed below the support around 12500, but, it did bounce off of the 10-day MA. The SP 500 shows similar charts to Nasdaq.

It closed below the support around 12500, but, it did bounce off of the 10-day MA. The SP 500 shows similar charts to Nasdaq.Now, the test is to see how fast can the bulls regroup, whether the 10-day MA will be strong enough as a support, and, if it is, whether the indices can continue the uptrend to re-test the Feb highs.

If we look closely, we can see that Nasdaq's 30-day MA is starting to flatten out. A few more consecutive up days should turn it up; but, we'll need to see some strong days, up 20-30 points, to catch up with the upper BB! The MACD and RSI are still rising nicely!

If we look closely, we can see that Nasdaq's 30-day MA is starting to flatten out. A few more consecutive up days should turn it up; but, we'll need to see some strong days, up 20-30 points, to catch up with the upper BB! The MACD and RSI are still rising nicely! See the 30-day MA flattening?! SPX is almost back to the level before the sell-off. Breaking above this level, which is about 1450, should bring a test of the Feb high!

See the 30-day MA flattening?! SPX is almost back to the level before the sell-off. Breaking above this level, which is about 1450, should bring a test of the Feb high! SOX had a strong day!  It closed up 3.81, at 476.58. Its MACD just turned positive today. We should see some continued, upwards momentum tomorrow!

It closed up 3.81, at 476.58. Its MACD just turned positive today. We should see some continued, upwards momentum tomorrow!

GLD, ETF tracking gold, also went up today.  Looks like it's starting to move along the upper BB!

Looks like it's starting to move along the upper BB!

OIH, ETF for the oil service industry, made a new 6-months high! It closed above 150, a psychological barrier, at 152. 52-wk high is at 169.75. It's getting toppy, but, the upwards momentum is still strong, and the monthly chart says there's still room to go!

It closed above 150, a psychological barrier, at 152. 52-wk high is at 169.75. It's getting toppy, but, the upwards momentum is still strong, and the monthly chart says there's still room to go!

Nasdaq was able to make a higher high, but, wasn't able to to hold it. We need very much to get that 30-day MA turned up. It would probably take more than a few consecutive strong up days to make that happen. Nasdaq needs to catch that upper BB and ride along it.

Nasdaq was able to make a higher high, but, wasn't able to to hold it. We need very much to get that 30-day MA turned up. It would probably take more than a few consecutive strong up days to make that happen. Nasdaq needs to catch that upper BB and ride along it.We should have taken a look at the weekly charts this weekend. Let's do it now: Nasdaq shows that it made a nice gain last week. Both MACD and RSI have started to turn up. So, the bias is still on the long side. Let's see if the trend can continue this week.

Nasdaq shows that it made a nice gain last week. Both MACD and RSI have started to turn up. So, the bias is still on the long side. Let's see if the trend can continue this week.

Gold also made a nice gain last week.  GLD's weekly chart looks really nice, with higher highs and higher lows. The MACD has started to go up again! The uptrend is still intact, but, it is getting a bit toppy.

GLD's weekly chart looks really nice, with higher highs and higher lows. The MACD has started to go up again! The uptrend is still intact, but, it is getting a bit toppy.

The oils also made good gains last week.  Similar story as gold, but, even a little more toppy. OIH made it all the way to 151.41 today, which almost touched the upper BB on the weekly chart. It might make another attempt sometime this week.

Similar story as gold, but, even a little more toppy. OIH made it all the way to 151.41 today, which almost touched the upper BB on the weekly chart. It might make another attempt sometime this week.

In order for the major indices to keep on going and re-test the February highs, they need to make a few sessions with solid gains. They all need to catch up to their respective upper BBs and turn their 30-day MAs up! And, SOX needs to participate in the big rallies to break out of their multi-year range. Gold, and rest of the metals, still seem strong. The oils, represented by OIH, may be getting toppy, but, the monthly chart is still bullish.

Nasdaq had a nice day on Thursday to close out the week (so did SP 500 and the DOW), showing that buyers are still in control. The 20-day MA has crossed above the 30-day MA, but, we still need to see that 30-day MA turn up. The Nasdaq needs to now catch up with the upper BB; this should enable the 30-day MA to turn up!

Nasdaq had a nice day on Thursday to close out the week (so did SP 500 and the DOW), showing that buyers are still in control. The 20-day MA has crossed above the 30-day MA, but, we still need to see that 30-day MA turn up. The Nasdaq needs to now catch up with the upper BB; this should enable the 30-day MA to turn up! The SOX made 3 nice, consequtive, days of advances to close above 475. Now, the MACD is almost positive and the RSI is rising nicely. Notice that the upper BB is not so far away!

The SOX made 3 nice, consequtive, days of advances to close above 475. Now, the MACD is almost positive and the RSI is rising nicely. Notice that the upper BB is not so far away! The biotechs are picking up a lot of momentum in the past few weeks. Let's take a look at BTK, the AMEX Biotech Index.  BTK closed on Thursday above the resistance at 790! It is now in the clear to go even higher. The MACD is also rising nicely and the strength is high, as shown by the RSI.

BTK closed on Thursday above the resistance at 790! It is now in the clear to go even higher. The MACD is also rising nicely and the strength is high, as shown by the RSI.  If fact, BTK is very close to re-testing its all-time high set in 2000(see the 10-year chart)!!

If fact, BTK is very close to re-testing its all-time high set in 2000(see the 10-year chart)!!

Another sector that looks interesting to me is the internet incubators. A lot of people have probably forgotten these since 2001. But, they seem to have recently gotten some renewed buying interests. CMGI, ICGE, and SFE have all made some nice upward movements lately. There's even an interesting article from Forbes about them.

So, the mjoar indices are in striking distance to re-test the February highs; the biotechs have taken off; the semiconductors are starting to move up (and, they need to break out of their multi-year range; see my post on 3/31/07); the commodities are still strong. If we see the buyers continue to push the major indices up and allow them to catch the upper BB, we might have new highs to look forward to in the next couple of weeks!

The daily charts are pretty much the same story, besides that we continued to rise and closed just above the immediate resistances. Nasdaq closed above the 2457 resistance, but, still need to see that 30-day MA turn up! MACD and RSI continue to rise.

The daily charts are pretty much the same story, besides that we continued to rise and closed just above the immediate resistances. Nasdaq closed above the 2457 resistance, but, still need to see that 30-day MA turn up! MACD and RSI continue to rise. We see that on the 15-minute chart, the MACD is flattening. If we find enough strength tomorrow to make this MACD rise up again, we may find that the buyers are still in control. I think it'll be interesting to see how the Asian markets hold up overnight tonight.

We see that on the 15-minute chart, the MACD is flattening. If we find enough strength tomorrow to make this MACD rise up again, we may find that the buyers are still in control. I think it'll be interesting to see how the Asian markets hold up overnight tonight.SPX, or the SP 500 index: SPX pretty much shares the same story as Nasdaq, but, a little better. Notice that its 20-day MA (blue line) has just risen above the 30-day MA (black line). Maybe it's something that Nasdaq can look forward to in the next couple of sessions?

SPX pretty much shares the same story as Nasdaq, but, a little better. Notice that its 20-day MA (blue line) has just risen above the 30-day MA (black line). Maybe it's something that Nasdaq can look forward to in the next couple of sessions?

How about the semiconductors? SOX made a nice advance to close above 470! The MACD has curved up and the RSI is rising. Even the 20-day MA turned up too! We need to see it break the resistance at 473.8 and go above 475!

SOX made a nice advance to close above 470! The MACD has curved up and the RSI is rising. Even the 20-day MA turned up too! We need to see it break the resistance at 473.8 and go above 475!

We should be cautious tomorrow, especially because Friday is a holiday; so, tomorrow is the last trading day of the week. In the next couple of trading sessions, we should be able to sort out the near-term direction of the markets. Commodities, however, still seem to be strong.

Nasdaq came near the immediate resistance at around 2457. It needs to break that and catch up with the upper BB. The MACD and RSI turned up nicely. We still want to see that 30-day MA turn up!

Nasdaq came near the immediate resistance at around 2457. It needs to break that and catch up with the upper BB. The MACD and RSI turned up nicely. We still want to see that 30-day MA turn up! Let's see what the intraday chart is saying:  The intraday indicators show that there is still some more room to go up! Let's see if we have enough momentum to break through that resistance around 2457. (The other major indices show similar near-term patterns.)

The intraday indicators show that there is still some more room to go up! Let's see if we have enough momentum to break through that resistance around 2457. (The other major indices show similar near-term patterns.)

GOOG, with an announcement of a satellite TV ad deal with EchoStar, had a great day, which probably helped spark the market rally also!.

GOOG caught the upper BB today and is ready to ride it up! MACD, RSI, MFI all turned up, and the buying volume was high!

GOOG caught the upper BB today and is ready to ride it up! MACD, RSI, MFI all turned up, and the buying volume was high! RIMM also caught up with its upper BB with technical indicators going up nicely!

RIMM also caught up with its upper BB with technical indicators going up nicely! So, tomorrow, we'll need to see the major indices break their immediate resistance levels. Then, we can hope to retest the highs set in February!

But, we still need to see that 30-day MA turn up (same story for the SPX, or SP 500). The 20-day MA is now going up nicely (blue line).

But, we still need to see that 30-day MA turn up (same story for the SPX, or SP 500). The 20-day MA is now going up nicely (blue line). The intraday, hourly chart can perhaps provide some missing clues. After we tested the bottom last Thursday, some sorting out and back-and-forth needed to happen. We see that Nasdaq now have gotten above the intraday MAs (similar actions exist for the SPX), we might see some upwards momentum tomorrow.

The intraday, hourly chart can perhaps provide some missing clues. After we tested the bottom last Thursday, some sorting out and back-and-forth needed to happen. We see that Nasdaq now have gotten above the intraday MAs (similar actions exist for the SPX), we might see some upwards momentum tomorrow. It made a nice advance above the resistance at 75.3 and had great volume to go with it. The MFI, RSI, MACD are all looking good. Might be in the 80s soon.

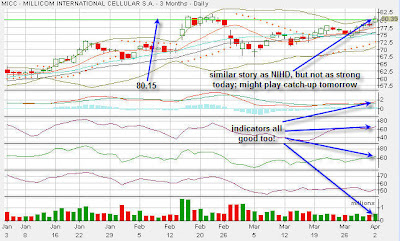

It made a nice advance above the resistance at 75.3 and had great volume to go with it. The MFI, RSI, MACD are all looking good. Might be in the 80s soon.MICC had some similar actions as NIHD, but, not quite as strong.  Indicators are all good and the volume went up a bit. 52-wk high is not that far away at 82.04. Catching the upper BB and closing above the resistance (80.15) may allow it to play some catching-up tomorrow and head for a new 52-wk high!

Indicators are all good and the volume went up a bit. 52-wk high is not that far away at 82.04. Catching the upper BB and closing above the resistance (80.15) may allow it to play some catching-up tomorrow and head for a new 52-wk high!

KYPH had a nice day, also!  It broke above resistance @ 45.5 with great volume. This thing may be ready for a new 52-wk high also, which is only 48.45.

It broke above resistance @ 45.5 with great volume. This thing may be ready for a new 52-wk high also, which is only 48.45.

In Nasdaq's monthly chart, we actually see that it has behaved very well within the boundaries of an up-trend for years. There are areas where it tested the lower boundary, including this past week, but, it bounced back quickly. The monthly MAs are still going up strongly with the 10- above the 20-, above the 30-month MA. The uptrend is still intact!

In Nasdaq's monthly chart, we actually see that it has behaved very well within the boundaries of an up-trend for years. There are areas where it tested the lower boundary, including this past week, but, it bounced back quickly. The monthly MAs are still going up strongly with the 10- above the 20-, above the 30-month MA. The uptrend is still intact! The 20-day MA is curving up nicely!

The 20-day MA is curving up nicely!What about the SOX?  The semiconductor sector, basically, have done a whole lot of nothing for years. But, notice that the monthly BBs have been narrowing, and they have gotten to a point where, I think, breakouts may be possible in the next few months. On Friday, we also heard that Stifel Nicolaus upgraded the semiconductor sector. Is this the first of many upgrades to come? We'll have to wait and see.

The semiconductor sector, basically, have done a whole lot of nothing for years. But, notice that the monthly BBs have been narrowing, and they have gotten to a point where, I think, breakouts may be possible in the next few months. On Friday, we also heard that Stifel Nicolaus upgraded the semiconductor sector. Is this the first of many upgrades to come? We'll have to wait and see.

SPX (SP 500): SPX's month chart is still showing the MAs going up. Although it looks toppy, but, if the new month brings it right back to the upper BB, the whole picture becomes very bullish again!

SPX's month chart is still showing the MAs going up. Although it looks toppy, but, if the new month brings it right back to the upper BB, the whole picture becomes very bullish again!

MDY (mid-caps): Now, this is where this money has been, is, and might still be going! We can see that since April of 2003, this thing has been climbing, and climbing, along the upper BB. Even with the recently sell-off, it still came out with a nice gain in March. Now, it is, again, hugging the upper BB, and, with the 10-month MA curving up even more! So, it might be a good idea to check out some of its top holding!

Now, this is where this money has been, is, and might still be going! We can see that since April of 2003, this thing has been climbing, and climbing, along the upper BB. Even with the recently sell-off, it still came out with a nice gain in March. Now, it is, again, hugging the upper BB, and, with the 10-month MA curving up even more! So, it might be a good idea to check out some of its top holding!